You want to find private money lenders—and who can blame you?

These go-to resources are one of the best assets you can have as a real estate investor. If you can rally a few quality private money sources for your investing business, you’ll be well positioned for success. At the end of the day, funding is the lifeblood of any investor. If you tee up rock solid funding from a few diverse sources and, as a result, create an unlimited funding stream, then you’re wading into all-star territory. The very best real estate investors are the ones who can cross that finish line. And the best part? It’s not impossible—far from it, really. It takes diligence, patience and a commitment to succeed. If that sounds like you, you’re halfway there.

So back to the private money which, likely, will be a huge piece of that lucrative funding stream. Between all the networking, relationship building and mixing and mingling you’re doing, there’s a good chance you overlooked one of the best sources for private money connections out there: public records. Every single real estate transaction that happens leaves a very clear-cut, very public trail in its wake. Your job? Follow those breadcrumbs all the way to your next great private money lender.

SHOW ME THE MONEY!

Ready to start searching? While there are a few ways to dig into public records, one of the easiest paths is via individual county clerk websites. A good number of counties have the resources and records you’re looking for at the ready—a quick Google search should turn up county clerk websites for the areas you’re investing in.

Finding a relevant county site will save you endless hours at the County Clerk’s office, pouring over documents. This is one of the simplest ways to get the intel and insights you need to build your private money database up fast.

So what can you find on a county clerk website?

While all sites are different, the majority offer searchable public records, including real estate closings and deals. By digging into these, you’ll be able to figure out who funded deals in that particular county. While most will be banks, credit unions and lenders, some will be individuals and small business-sounding names—and that’s where your private money trail begins.

Let’s run through a sample private money search…

Let’s say you want to invest in properties in Florida. You’re interested not just in private money lenders in Florida but, instead, in finding any private money that’s been invested for area deals recently.

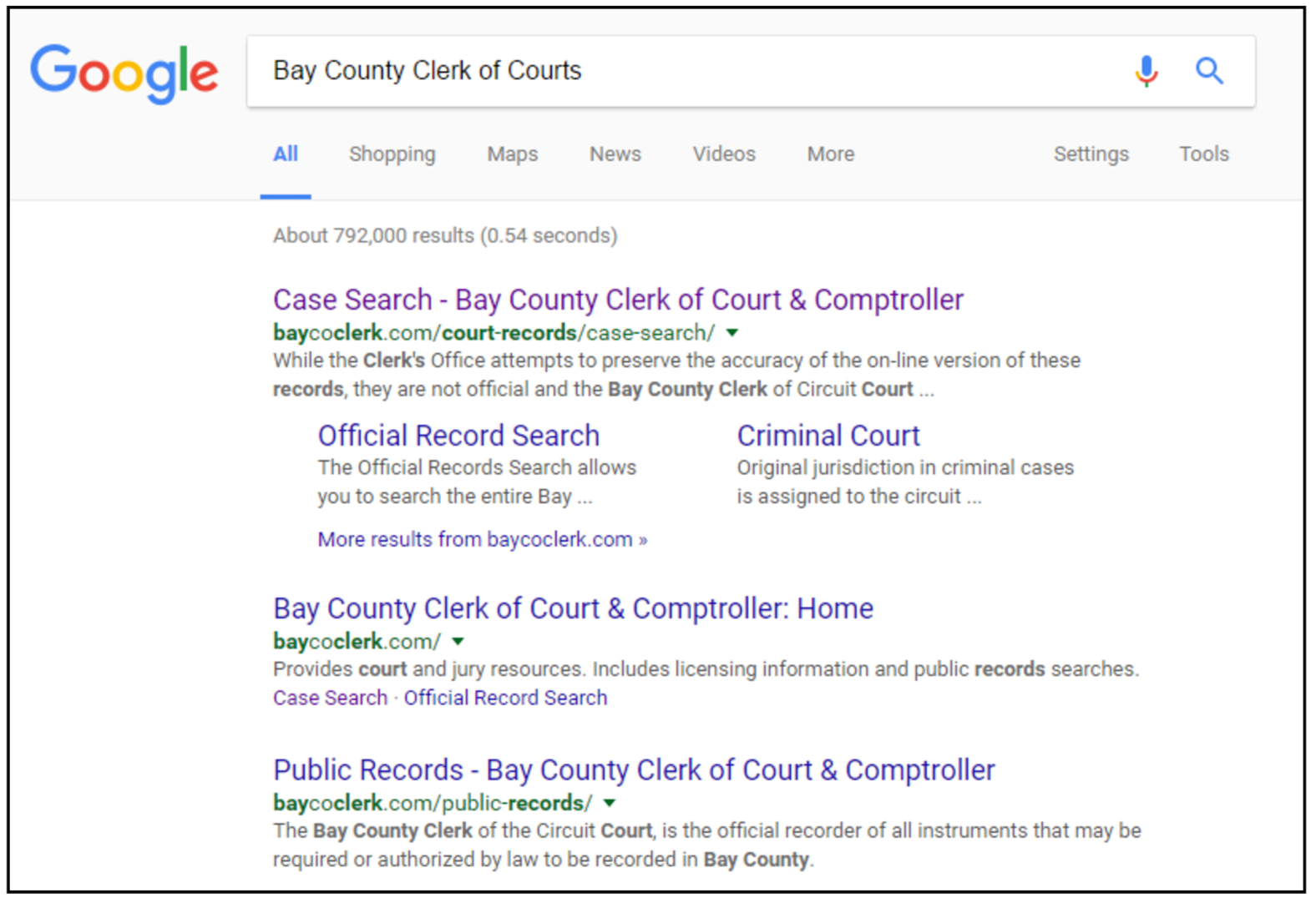

First, I’ll narrow my search down to the county level. In this case, I’m interested in Bay County, Florida. A quick Google search gets me to the correct site:

The first link is the County Clerk of Court—exactly where I need to be to search real estate records.

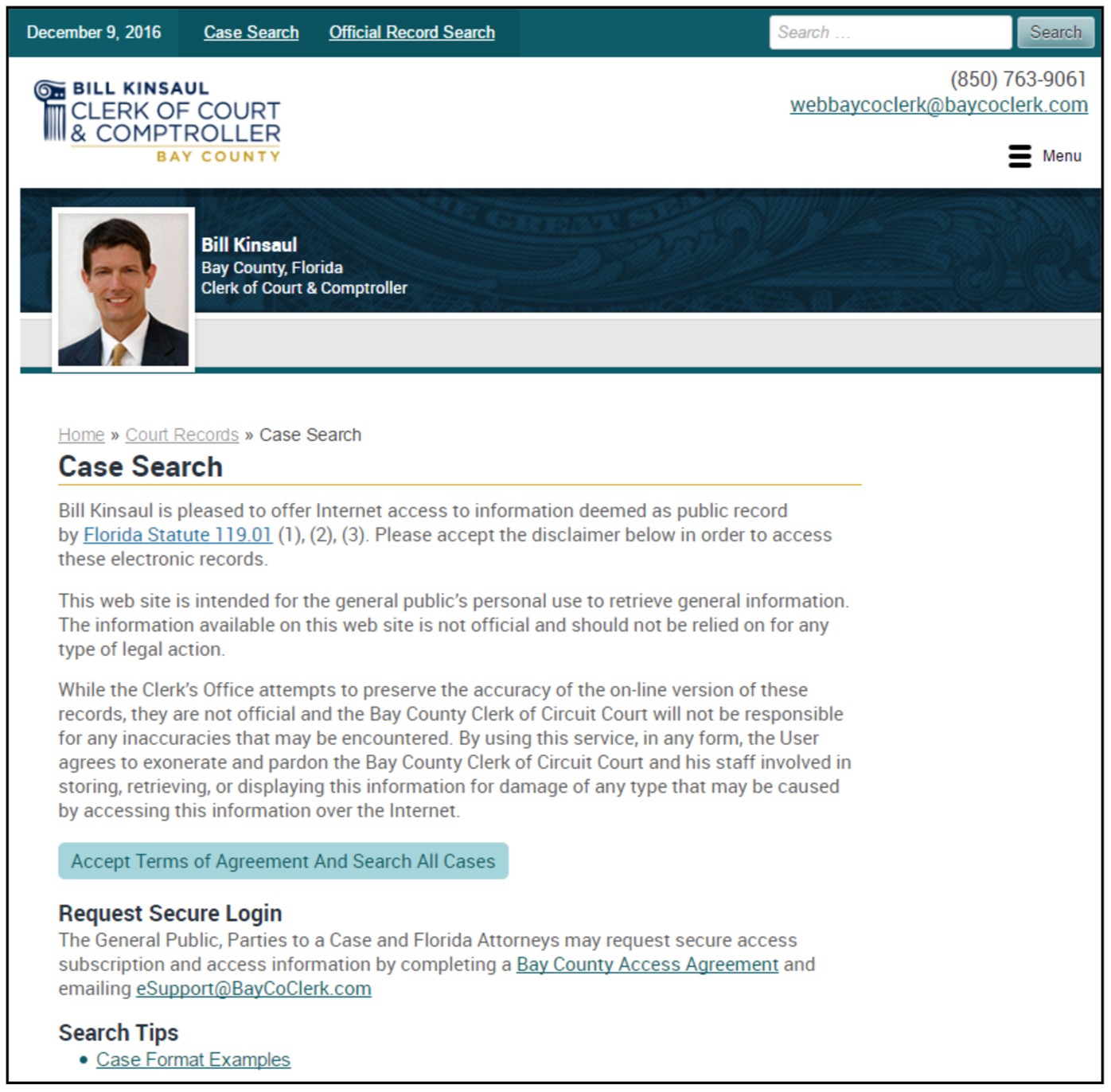

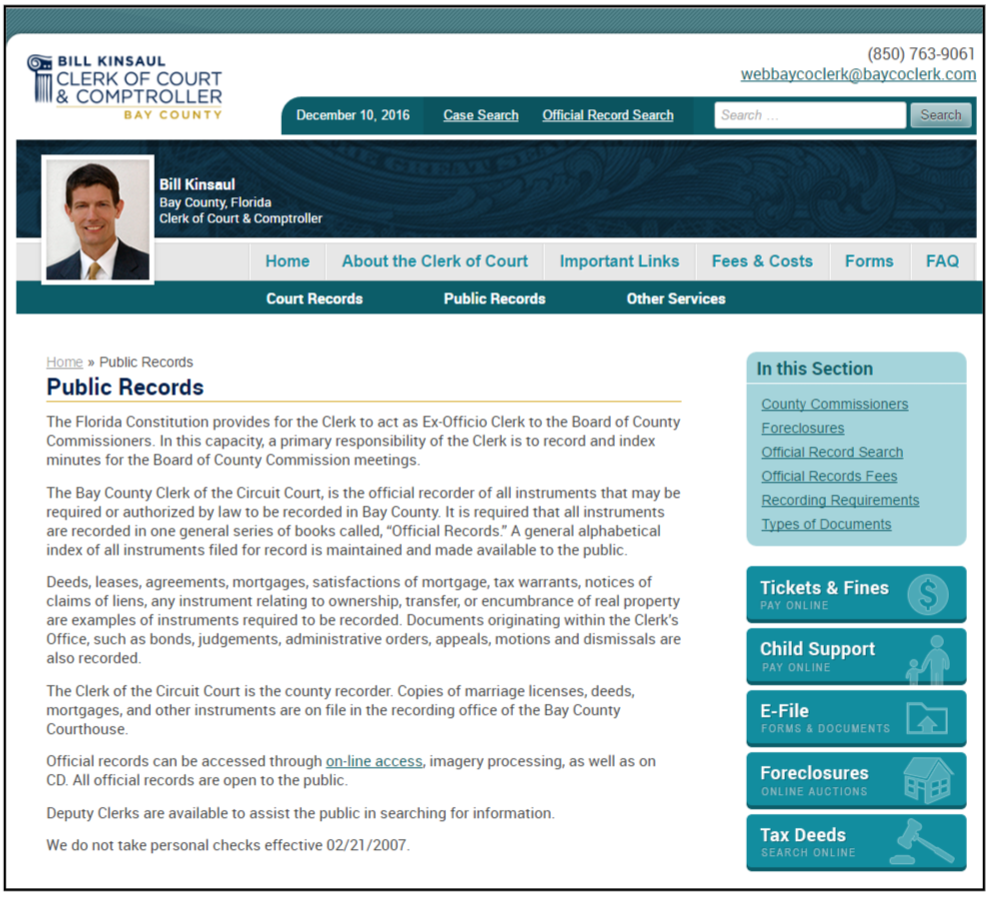

Look for a link to public records:

This gets me to a landing page that outlines my search options:

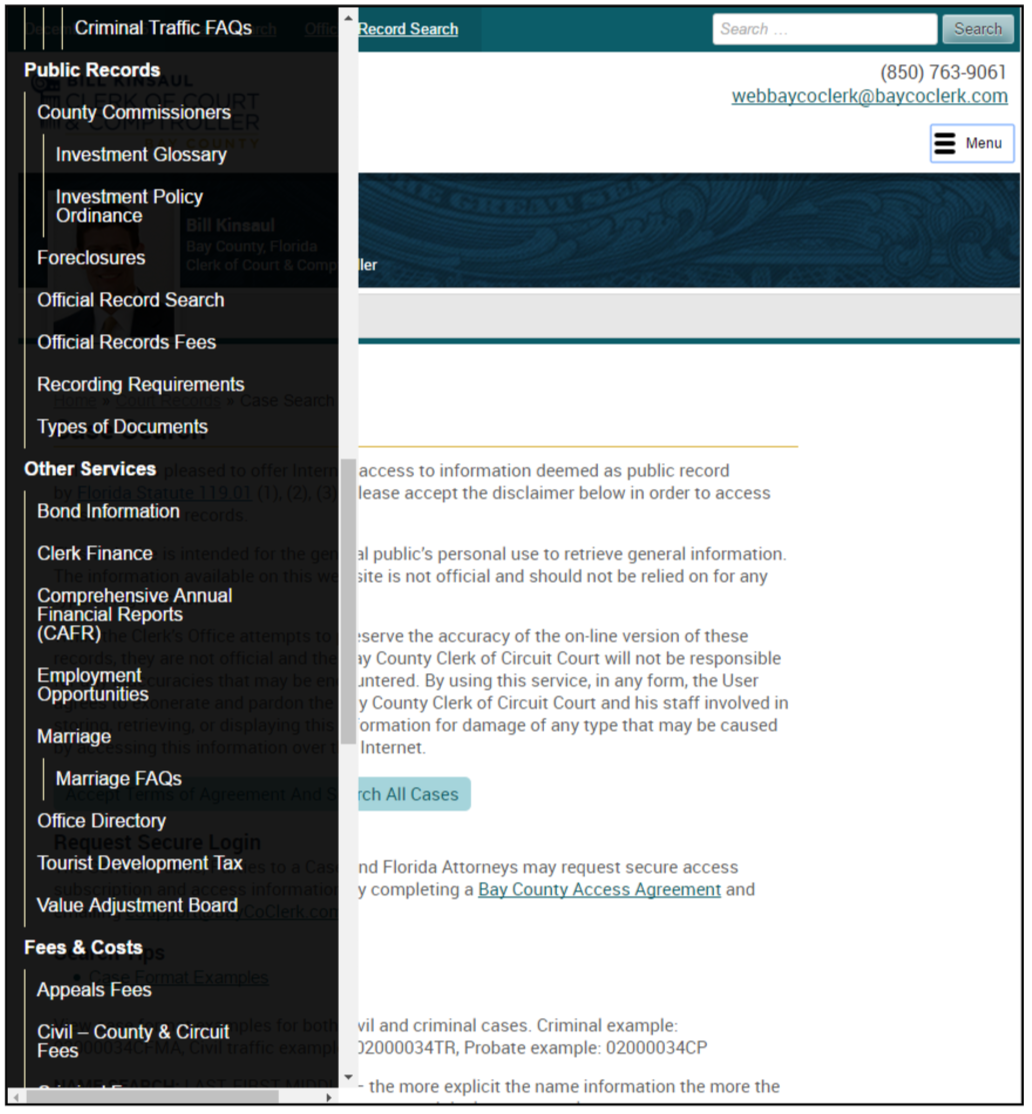

On this site, I click “Official Record Search” to begin searching closings. Again, every site is different—some many not have all of these steps, some may have additional steps, some may have less. Either way, though, be sure you get to the public record search function. That’s where you’ll need to be to start digging into real estate public records.

On the Bay County site I click “Search Official Records Now” to begin searching:

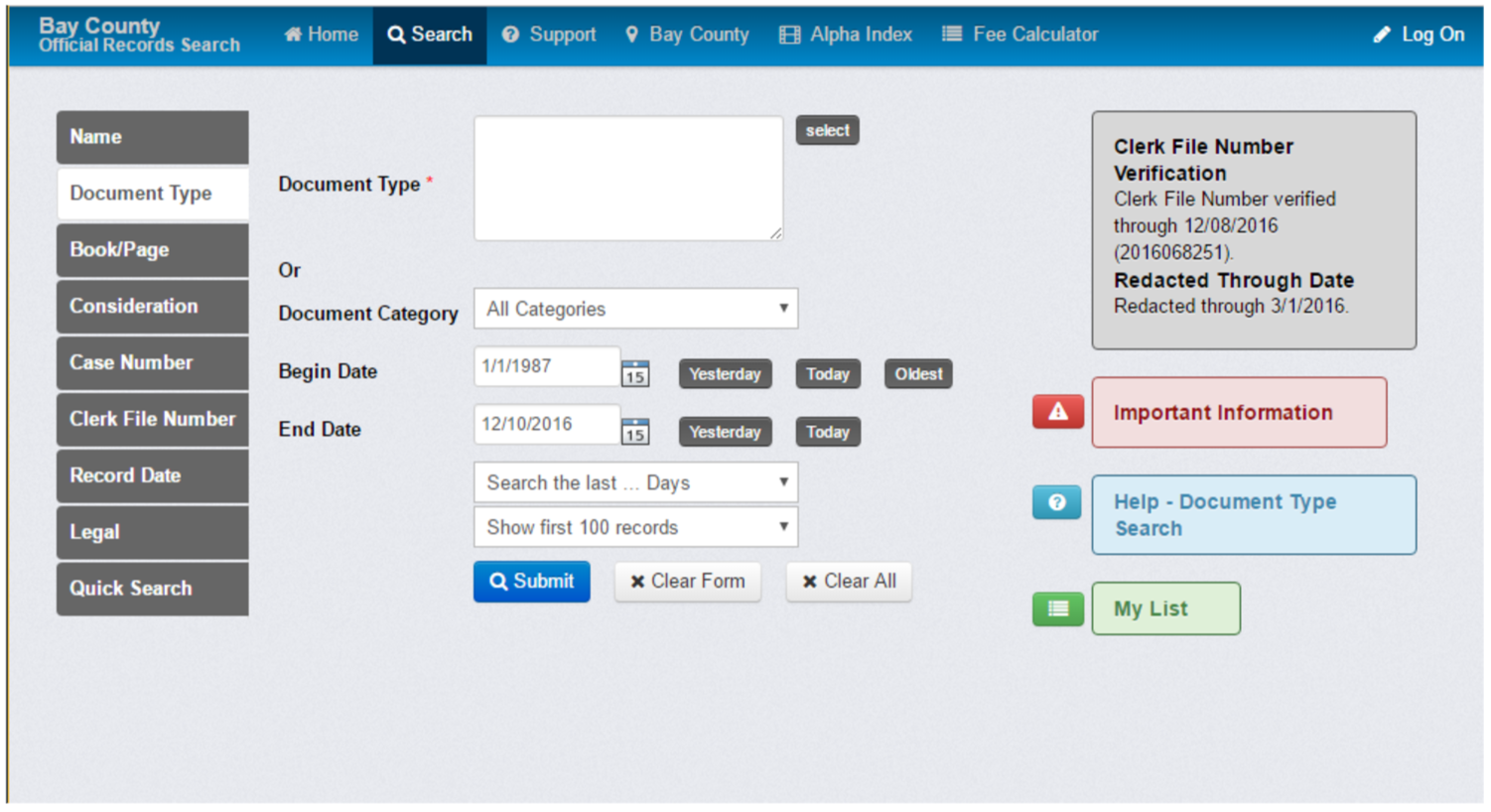

Next, I click “Document Search”—on most county sites you’ll want to search by document(s).

In the “Document Type” space I enter “mortgage.” In some states you’ll want to search for mortgages, while in others you’ll search for deeds of trust—it just depends on the state.

Bay County allows you to search back as far as 1987—way more info than I need. To make sure your private money search is relevant and timely, pick a smaller timeframe. Usually, I’ll start with the last 12 months or so and narrow down from there.

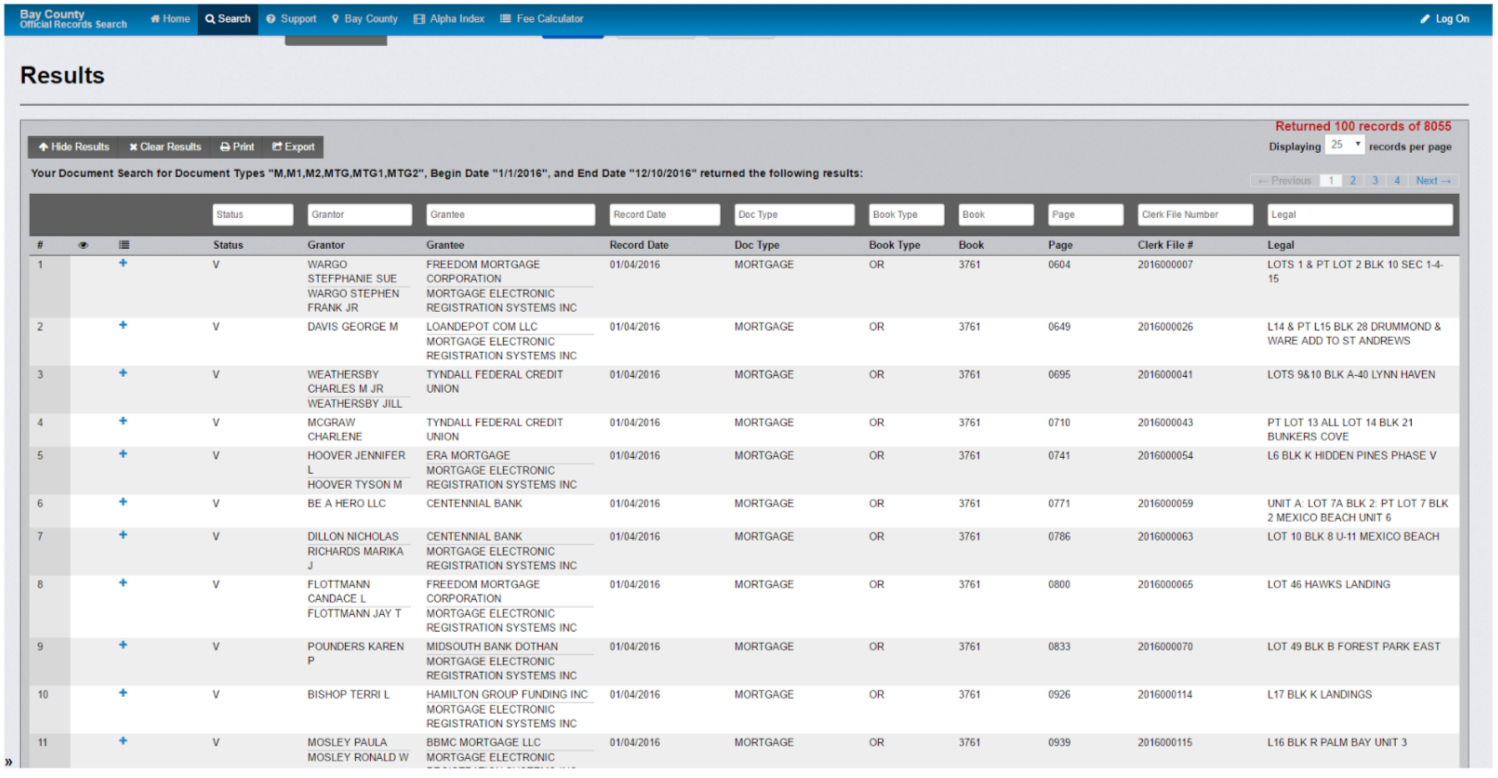

In this case, I wind up with a little more than 8,000 results. From here, you can either narrow your timeframe or just dive in. You won’t be pouring through every single closing, so if you decide to stick with the longer list, don’t worry—it will still be a relatively painless process, I promise.

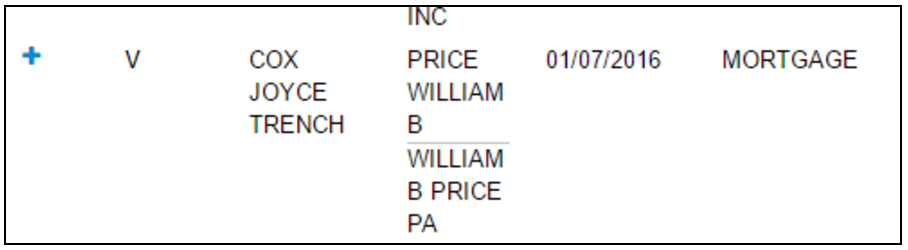

With your final list, scan for records with individual names listed under “Grantee.” This is the person or business entity that funded the deal. In some states you’ll look for “Mortgagee”—either way, it’s the same thing.

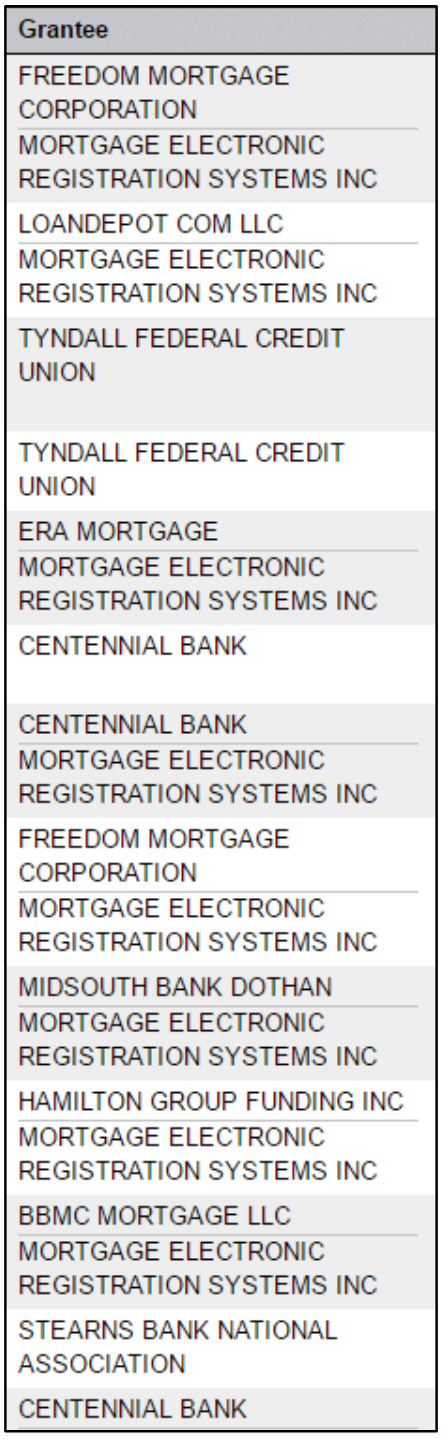

Scan for names that don’t look like banks, credit unions, and major lenders. Usually, that’s not too tough—most of the Grantees or Mortgagees you’ll see will be familiar banks, obvious companies or have clues like “Credit Union” or “Mortgage Bank” in the name.

Here’s one that doesn’t look like a traditional bank:

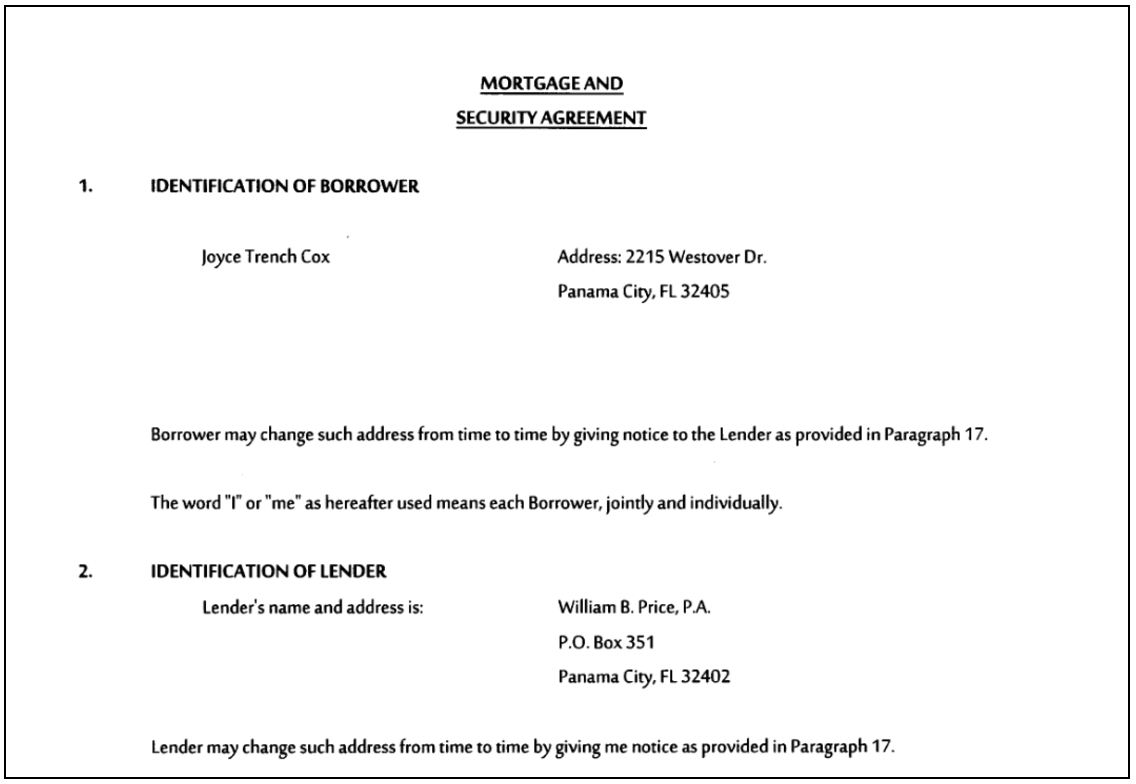

Click on the document to get additional information, including a copy of the executed recorded mortgage and security agreement. This will identify the lender and give their address and full name/business name, how much they loaned, the buyer/investor and some basic terms.

After that? Rinse and repeat.

Search for individuals and small business entities—those tend to be private money, too. Keep a running list of the lenders, their contact info and any specifics about the deal that you think could be relevant—the type of property, for example, the amount loaned, payoff terms and things like that.

As you continue to search and log your findings, you’ll start to notice trends—the same private money lenders appearing over and over, types of deals they seem to be funding fairly consistently and what, overall, seems to be “in demand” with these critical lenders.

And if you do hit a wall?

Don’t be afraid to pick up the phone and call your local courthouse. More often than not you can find someone to help direct you if links aren’t working or if you can’t find the right path to the real estate records. So don’t give up if you don’t see what you’re looking for immediately. It’s usually there, somewhere. And once you find it—or once you’re pointed to it—your search gets infinitely easier.

So…what NEXT?

Remember, you can’t just start lobbing random deals at potential private money sources. Not only is that bad business, but you could land in some serious hot water with the SEC. Instead, focus on building relationships with prospective lenders. Send short letters or postcards introducing yourself and driving to your website—nothing too promotional, just a friendly getting-to-know-you note.

Do a little digging and see what you can find out about your private money sources. Maybe there’s an easy way to connect via social media or their website, or maybe they frequently attend industry events and you can make an in-person intro there. No matter how you approach it, though, don’t forget about the relationship side of things—that’s always the most important.

The takeaway? There is endless funding just sitting there in your local public records, waiting to be discovered. Take the time to dig in and find it. Once the financing starts rolling in, you’ll be glad you did.